Planning and investing for a better quality of life

The HSBC Quality of Life Report captures insights from 11,230 affluent investors across 11 markets, to understand what they consider to be a good quality of life.

This report explores the relationship between physical and mental wellness, and financial fitness. It highlights people's life priorities and preparedness towards wealth management and financial planning – and how they evolve across generations.

How do you see your wealth balance?

TED - Quality of Life explainer video

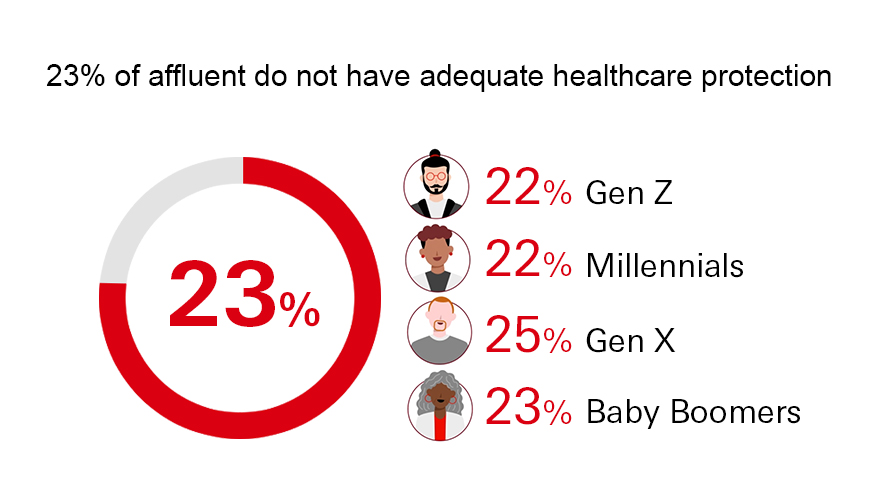

Key findings

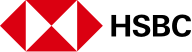

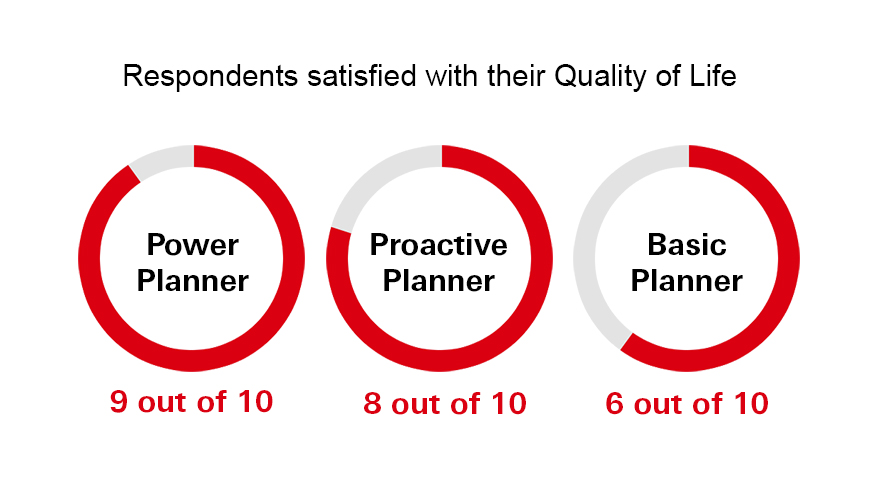

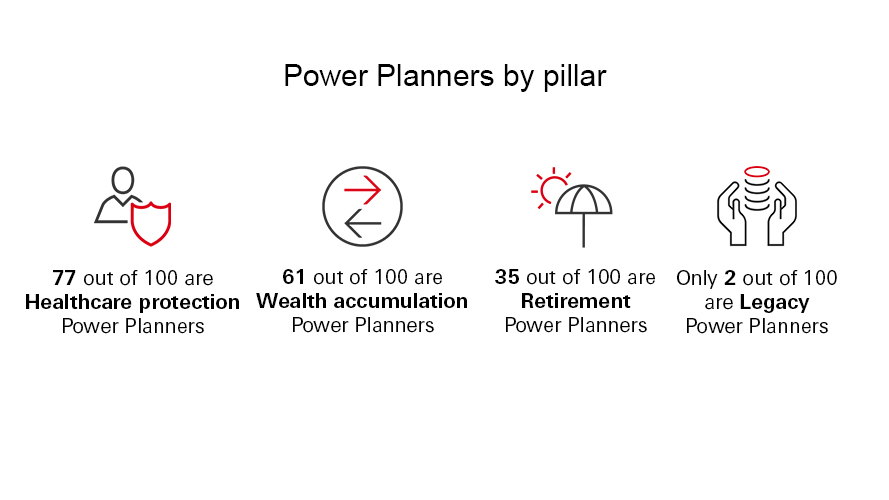

Planning for a better quality of life

The HSBC Quality of Life Report

Explore the full report

Download the global edition of the HSBC Quality of Life Report.

Find out your Quality of Life score

Tell us about your lifestyle and we'll calculate your score. We'll ask about your financial knowledge, planning habits, fitness, and mindset. You'll also get tips that will help you set achievable goals and increase your quality of life. You can come back and calculate your score in the future to see if it improves.

Learning more about quality of life and wellbeing

Through the HSBC Research Fellowship at University of Oxford, we are supporting some of the leading researchers in the science of Wellbeing.

Click the videos below to learn more about their perspectives on quality of life and wellbeing.