Planning and investing for a better quality of life

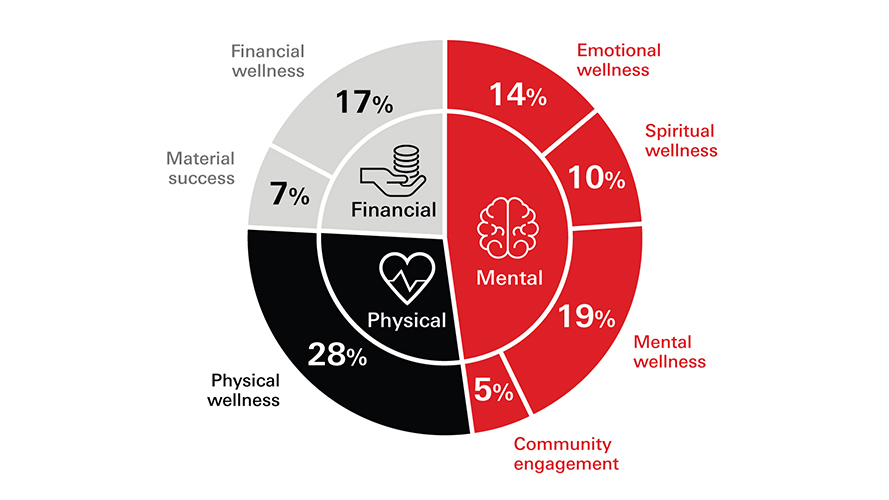

The HSBC Quality of Life Report 2023 interviewed over 2,250 individuals across 9 different markets to understand what they consider to be a good quality of life.

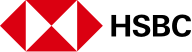

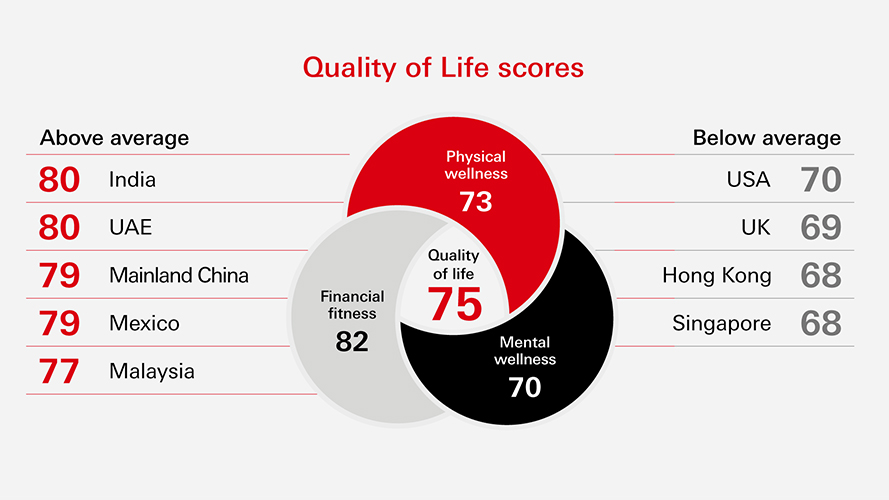

The report uncovers the connections and balance between physical and mental wellness with financial fitness and how they differ between generations.

It also explores 4 main priorities shaping how people plan and prepare for their short, medium, and long-term life goals.

How do you see your wealth balance?

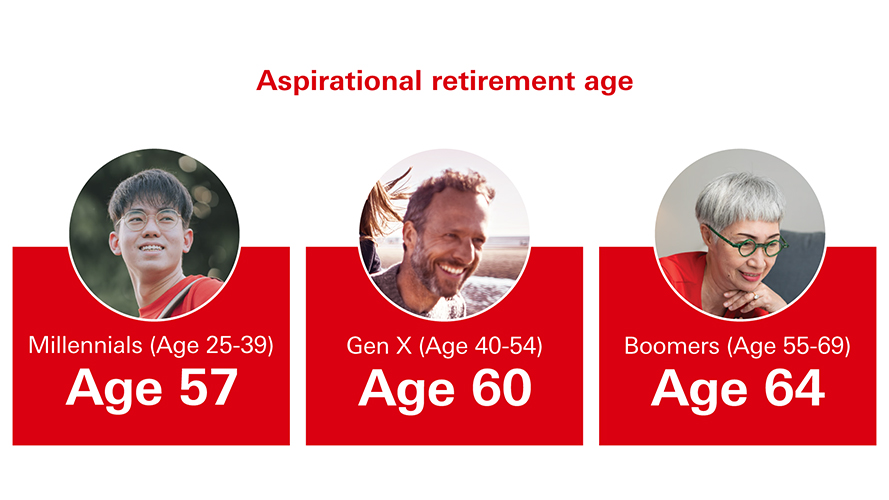

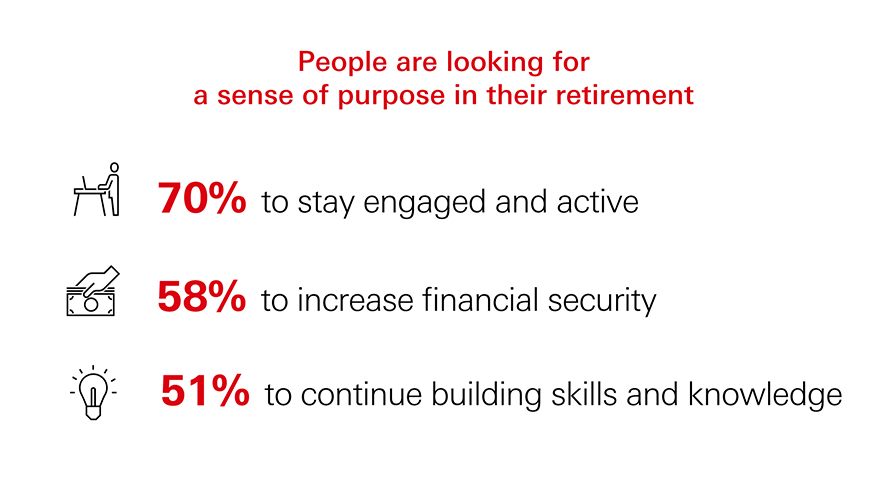

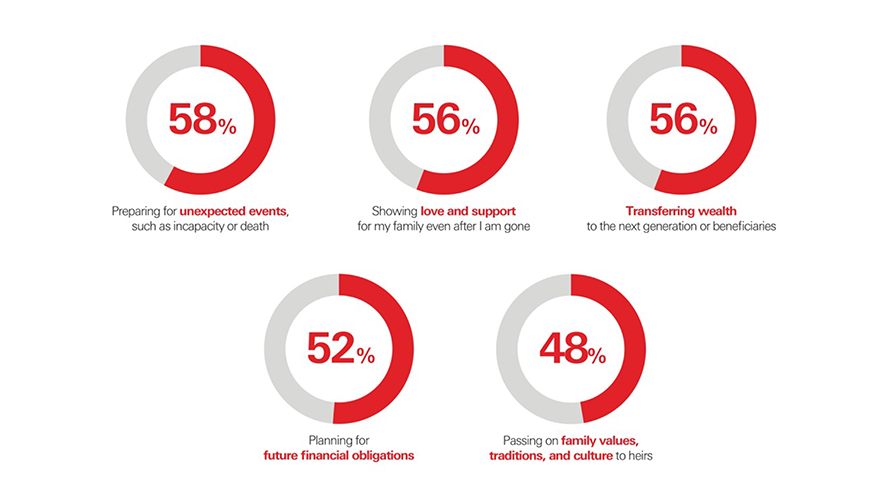

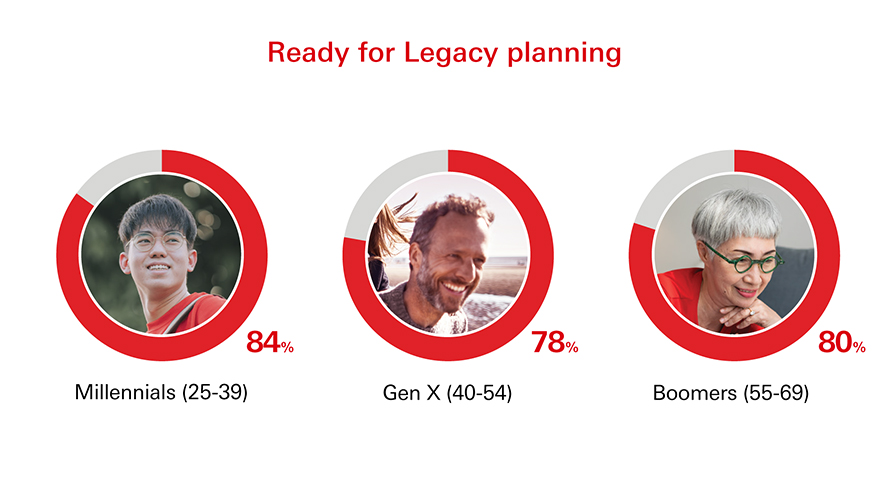

Key findings from study participants

Four global priorities

The HSBC Quality of Life Report 2023

Explore the full report

Download the global edition of the HSBC Quality of Life Report 2023.

Find out your Quality of Life score

Tell us about your lifestyle and we'll calculate your score. We'll ask about your financial knowledge, planning habits, fitness, and mindset. You'll also get tips that will help you set achievable goals and increase your Quality of Life. You can come back and calculate your score in the future to see if it improves.

Learning more about quality of life and wellbeing

Through the HSBC Research Fellowship at University of Oxford, we are supporting some of the leading researchers in the science of Wellbeing.

Click the videos below to learn more about their perspectives on quality of life and wellbeing.