HSBC Affluent Investor Snapshot 2025: A Quality of Life special report

The HSBC Affluent Investor Snapshot: A Quality of Life special report captures insights from 10,797 affluent investors in 12 markets on their investment behaviours, objectives and attitudes.

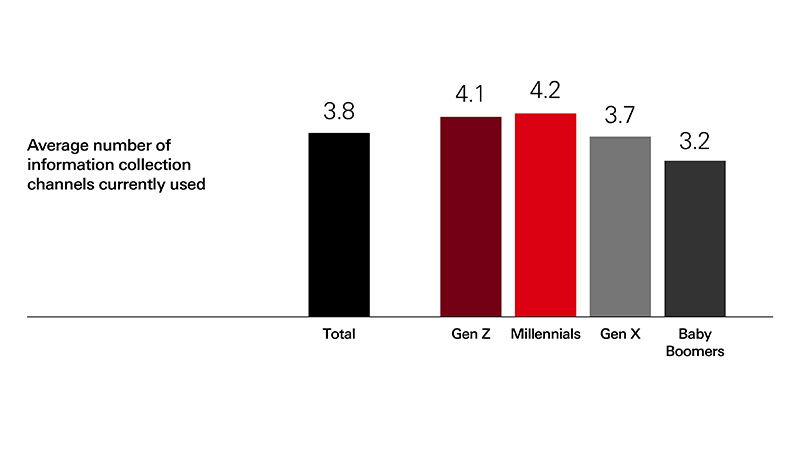

This report highlights key findings such as how affluent investors are becoming more intentional in how they manage their wealth, and how investors source knowledge from an information-rich environment across different generations.

Key findings

Wealth, trust and evolving goals for the affluent investor

Explore the full report

Download the global edition of the HSBC Affluent Investor Snapshot: A Quality of Life special report