Here's some important pointers to help you chart your course and grow your long-term wealth across global markets.

Short-term volatility is a normal part of the investment process. Markets can fluctuate in response to headline-grabbing news, but this doesn't necessarily derail long-term growth.

Significant market recoveries have historically occurred after major setbacks – including economic downturns and geopolitical events. That's why it's important to avoid panic selling during volatile periods, especially if you want to avoid missing out on a potential market recovery.

For instance, if you had invested USD10,000 in equities in 2006, it would have taken a big hit during the 2008 financial crisis. But if you held on to your investment it would have grown to USD17,182 by the end of 20151, thanks to the market's healthy recovery.

When things get rocky, it might be tempting to exit the market to avoid further losses. But history has shown that financial markets go up in the long run despite short-term fluctuations. And if you react to the immediate crests and troughs, you might end up buying high and selling low.

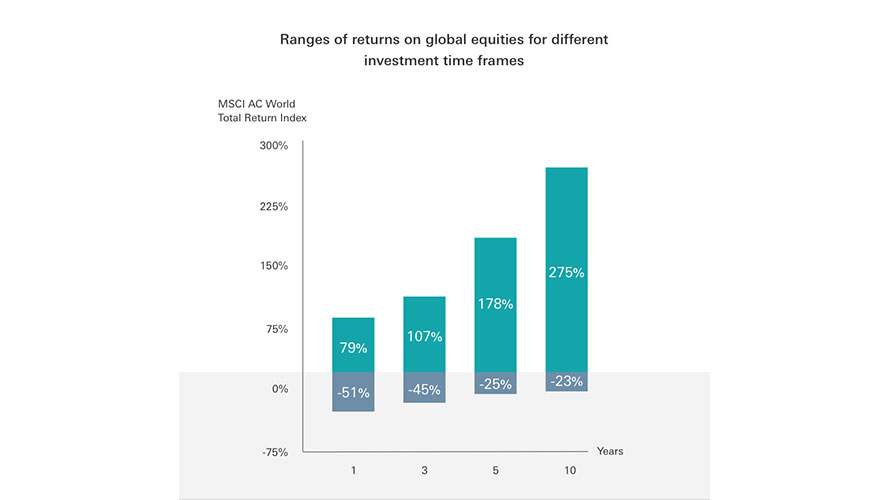

Though the indices don't always follow the same recovery path, the period after a correction is often a critical time to be in the markets. So staying invested for the long haul tends to offer higher return potential.

Source: Bloomberg, as of 31 December 2018, calculated by rolling returns in USD within 1-year, 3-year, 5-year and 10-year timeframes. Index used: MSCI AC World Total Return Index. Past performance is not an indication of future returns. The performance may go down as well as up.

It's something you'll hear again and again when it comes to investment: "Don't put all your eggs in one basket". Asset diversification can lower your overall portfolio risk, as separate asset classes often perform differently under various market conditions.

Investing in only one type of asset class can be more risky as its performance can fluctuate significantly within a short period of time. For instance, the MSCI Emerging Market Equity index was the best-performing asset class in 2017 with 37.28% return, but it went on to become the worst performer in 2018 with -14.58% return2.

Combining assets with diverse characteristics marries the risks and potential rewards of different investments. A lower return in one type of asset may be compensated for by a gain in another.

Don't be passive in the face of market declines. Instead, see them as chances to act. When market sentiment is low, valuations are often driven down as people sell. But that provides golden investment opportunities for savvy investors.

Though no one can predict market movements, periods when many investors are overwhelmingly negative often turn out to be the best times to invest.

From 1996 to 2018, prices in the market have fluctuated regularly. The market had significant downturns in the 2008 financial crisis and 2011 European sovereign debt crisis. However, the market also soared to a price-to-book ratio of 2.7X by the end of 20183.

What's the best way to overcome market fluctuations? By making regular fixed investments. Buying more units when prices are low and fewer units when prices are high reduces the risk of investing a lump sum at the wrong time.

This is called "dollar-cost averaging", and it can help smooth out your investment journey. It also provides a longer time frame for your investments to grow.

The right approach can help you weather the challenging conditions and capitalise on the opportunities of volatile markets. With our portfolio of investment solutions, you can make confident, knowledge-backed decisions to achieve your wealth ambitions.

Ready to take your global investments to the next level? Our trusted services and expertise can empower you to realise your goals in international markets.

We can tell you the best way for you to apply for an overseas account. Simply select your current location and where you would like to open an account. We'll then walk you through the steps.

HSBC Holdings plc has prepared this article based on publicly available information at the time of preparation from sources it believes to be reliable but it has not independently verified such information. HSBC Holdings plc and the HSBC Group (together, "HSBC") are not responsible for any loss, damage, liabilities or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use of or reliance on this article. The contents of this article are subject to change without notice. HSBC gives no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this article.

This article is not investment advice or a recommendation nor is it intended to sell investments or services or solicit purchases or subscriptions. This article should not be used as the basis for any decision on taxation, estate, trusts or legacy planning. You should not use or rely on this article in making any investment decision. HSBC is not responsible for such use or reliance by you. Any market information shown refers to the past and should not be seen as an indication of future market performance. You should always consider seeking professional advice when thinking about undertaking any form of prime residential or commercial property purchase, sale or rental. You should consult your professional advisor in your jurisdiction if you have any questions regarding the contents of this article.

1 Source: Bloomberg, as at 31 December 2018. Index used: S&P500 Total Return Index.

2 Source: Morningstar, HSBC Global Asset Management, data from January 2010 to December 2020. All returns in USD, total return.

3 Source: Bloomberg, MSCI AC World Daily Total Return Index, data as of 31 December 2020.