Carbon dioxide (CO2) emissions, primarily from burning fossil fuels, account for 70% of greenhouse gases (GHGs) in the atmosphere. Since these have a profound effect on global warming, governments, companies and investors are looking towards net-zero policies to speed up decarbonisation.

Technological innovation and energy efficiency can reduce major sources of CO2 emissions from four sectors: power generation, transport, buildings and industrials. These "decarbonisation pathways" have the potential to reduce total emissions by 81% by 2050.

Given the high proportion of carbon created by power generation, expanding decarbonisation technologies in this sector can lead to significant change.

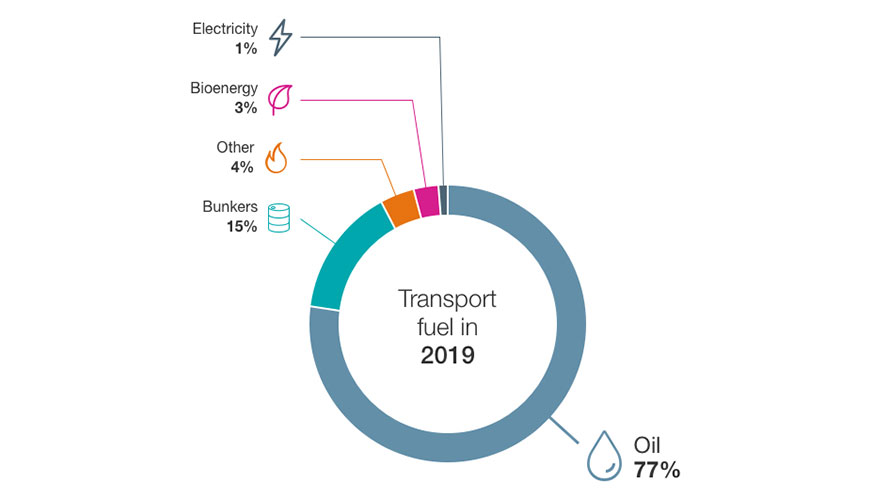

With more alternatives to petrol power, and increasingly stringent regulations, the transportation sector is quickly evolving.

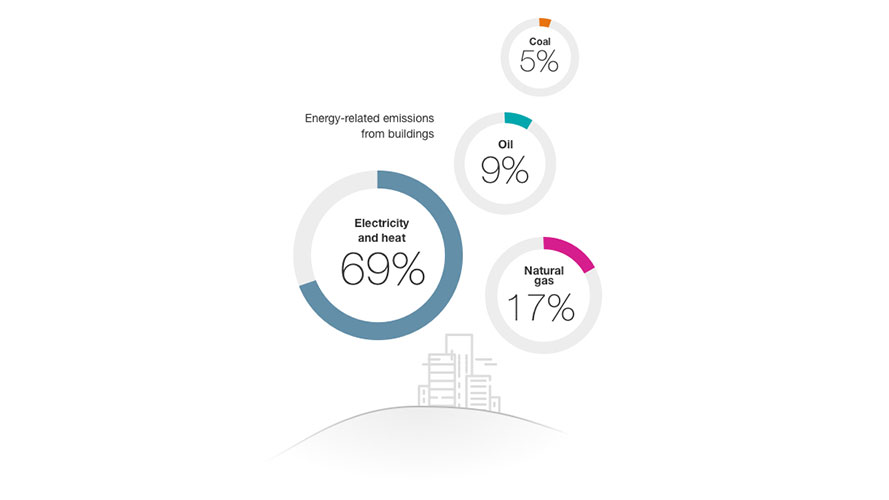

Fossil fuels heat and cool structures around the world. However, new technologies like hydrogen gas, as well as new building codes, will make a big difference.

Mining, metal processing, and the production of gas and oil can be carbon intensive. Electrifying these industries could make them much cleaner.

Energy efficiency and renewable alternatives play critical roles in the drive towards net zero. And investments in specific technologies can speed up this effort. Investors should watch emerging developments aimed at lowering emissions, as they will be key to limiting global warming.

Begin your sustainable investing journey and discover other ways HSBC can support your wealth ambitions.

We can tell you the best way for you to apply for an overseas account. Simply select your current location and where you would like to open an account. We'll then walk you through the steps.

HSBC Holdings plc has prepared this article based on publicly available information at the time of preparation from sources it believes to be reliable but it has not independently verified such information. HSBC Holdings plc and the HSBC Group (together, "HSBC") are not responsible for any loss, damage, liabilities or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use of or reliance on this article. The contents of this article are subject to change without notice. HSBC gives no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this article.

This article is not investment advice or a recommendation nor is it intended to sell investments or services or solicit purchases or subscriptions. This article should not be used as the basis for any decision on taxation, estate, trusts or legacy planning. You should not use or rely on this article in making any investment decision. HSBC is not responsible for such use or reliance by you. Any market information shown refers to the past and should not be seen as an indication of future market performance. You should always consider seeking professional advice when thinking about undertaking any form of prime residential or commercial property purchase, sale or rental. You should consult your professional advisor in your jurisdiction if you have any questions regarding the contents of this article.

1 UNEP, HSBC

2 International Energy Agency (IEA), HSBC

3 IEA, The World Resources Institute, HSBC

4HSBC Global Research